Among the crowded small shops on Bangalore's Bazaar Street is a small kiosk filled with oil cans of all sizes and shapes. Standing among them, Nirmal is busy serving customers. He has sold all kinds of edible oil from this tiny shop for 25 years – groundnut oil, ghee, sunflower oil, coconut oil and palm oil.

He has also led the 200 or so other traders with shops in Bazaar Street in a successful 20-year resistance against eviction to make way for the construction of a new mall.

Around 25 years ago, the city government proposed to demolish the stalls and replace them with a mall. Nirmal refused to move and began organising resistance. In his view, losing the stalls would affect not only the traders, but their regular customers. “Most of the customers are unskilled labourers on day wages. In the supermarket you cannot ask to buy cooking oil for only 5 rupees (8 cents US)," he says. “These low income customers that we serve every day won't be able to afford to buy anything if these stalls are to be replaced by a mall.”

Bazaar Street enjoys a strategic location in the heart of Bangalore, not far from the busy Yesvantpur Railway Station. Here you can buy different kinds of fresh produce, fruits, vegetables, and spices that the traders get from the local farmers of surrounding villages through agricultural produce market committee. APMC is created by the government to facilitate farmers to sell their produce and get reasonable prices.

The mall will almost certainly be occupied by retailers like the transnational giant Metro, which has already opened a wholesale market a few hundred metres away. It would be part of a major shift in the production, distribution and sale of food in India and across Asia that is having a major impact on the region's small scale traders and processors, its fresh markets and street vendors.

In the past decade or so, food corporations have been taking over a bigger and bigger slice of the pie, with major implications for the entire food chain. Corporate supermarkets are expanding faster in Asia than anywhere else on the planet. And as supermarkets and their procurement chains expand, they take revenue out of traditional food systems – and out of the hands of peasants, small scale food producers and traders. They also exert increasing influence over what people eat and how that food is produced.

"The traditional market has its roots in the community," says Suresh Kadashan from FDI Watch India, who has worked with Nirmal and hundreds of street vendors in Bangalore for the past 15 years. "Where will all these people go if they lose this place? The malls could never come close to absorbing all of them as workers.”

Asia continues to rely on traditional food systems for most of its food supply. But the entry and aggressive expansion of multinational food corporations, beverage companies and supermarket chains over the past decade has had major impacts on Asia's farmers, food workers, traders, and consumers.

Armed with various trade and investment regulations such as food safety regulations, these multinational food distribution chains push aside small scale food producers and fresh market traders and erode food diversity. GRAIN decided to look deeper at how changes in food distribution, particularly through supermarket expansion in Asia, influence small scale food producers and traders who rely on fresh markets for their livelihoods and how these changes affect people's diets and health.

Opening the flood gates to supermarket expansion

The expansion of supermarkets in Asia is being driven by the same factors as in other regions: by income growth and rapid urbanisation on the demand side and by marketing and foreign direct investment (FDI) on the supply side. Retailers are using different store formats (from wholesale outlets to hypermarkets to convenience stores) to avoid restrictions on foreign investment or municipal zoning laws and to maximize their reach, penetrating into every possible neighbourhood.

India began opening its retail sector to foreign investment in 2006 by allowing 100% FDI in cash and carry wholesale trading. Then in December 2013, despite tremendous public protest, India's central government enacted new FDI policies allowing foreign retailers to own up to 51% of multi-brand retailers and 100% of single brand retailers, which, like IKEA or Apple, only sell their own product brands. Implementation, however, was left to each state government. Today, fresh markets still account for 98 percent of total food retail sales but the “organised” or “modern” food retail sector is growing rapidly. The number of modern retail outlets increased from an estimated 200 outlets in 2005 to 3,000 outlets in 2012.

While foreign investment liberalisation plays a crucial role in the growth of supermarkets in Asia, state or national investment is also significant. In China, the most actively expanding supermarket chains are state owned, and, in Japan, most existing corporate supermarkets are state-owned retailers that are now expanding into neighbouring countries (see Table 4).

Between 2007 to 2011, the number of retail outlets in Indonesia grew, on average, by almost 2,000 new outlets per year, increasing from 10,365 outlets to 18,152 outlets, with a presence in almost every city. The number of hypermarket outlets jumped from 99 to 167 over the same period. Nearly all of these stores are controlled by just a handful of powerful retail groups. Trans Retailindo, Hong Kong based Dairy Farms, 7 Eleven, Gelael Group, and the two most aggressive locally-owned retail chains, Indomart and Alfamart. Other than Dairy Farm, all of these groups are state-owned or joint ventures that receive financial support from foreign companies. For example, Trans Retailindo received a $750 million dollar loan from 13 international banks to acquire the Indonesian operations of the transnational retailer Carrefour in 2013.

In India, the corporate retail sector, which includes a mix of retail format supermarkets, hypermarkets, specialty and gourmet stores and convenience stores, remains dominated by large Indian companies. Their growth has been enabled by national and local regulations and development programmes that seek to replace fresh markets with supposedly safer and more hygienic corporate retailers.

Supermarketisation, changing the face of the Asian market

Supermarketisation, changing the face of the Asian market

Fresh markets are found across the region and provide consumers with fresh quality vegetables, fruits, meats and other food. These markets provide livelihoods to millions of people at multiple points along the distribution chain, from the small farmers who bring in their harvests to stall owners, to the street vendors and a vast range of other informal workers including porters and loaders. In Indonesia alone, there are 12.5 million stall owners operating in the 13,450 fresh markets registered in the country, and this figure does not include the many informal workers earning income from these markets.

Supermarkets pose a direct threat to the livelihoods of these people. As supermarkets expand, they capture an increasing share of the national expenditures on food, leaving the millions of people who depend on fresh markets and small retail shops with less overall revenue to share amongst themselves. A direct result of this in Indonesia, for example, is that the number of fresh markets in the country is shrinking by an average of 8.1% every year. The Indonesia Market Traders Union (IKAPPI) says that more than 3,000 fresh markets, each with dozens of kiosks, were shut down between 2007 to 2011, with the overall number of fresh markets declining from 13,450 to 9,950.3 When asked, nearly half of the traders said direct competition with supermarkets was their reason for having to close down their stalls.4

In Indonesia, the union of fresh market traders has launched various protests at the local level. In Bantul, Jogjakarta, for example, they have been arguing for the closure of convenience stores and supermarket chains located less than 3.5 kilometres from fresh markets.6 The traders are also demanding that local governments limit the opening hours of convenience store chains like 7-Eleven and Indomart that are currently open 24 hours a day.

No place for small farmers on supermarket shelves

Asia's small traders sit at the front end of the local food systems that ensure the procurement and distribution of food grown on millions of small farms across the region. These traders typically procure their fresh fruit and vegetables, meat, eggs and fish from wholesale markets where nearby farmers bring their produce daily.

Corporate retailers rely on totally different systems of procurement and distribution. Each supermarket chain coordinates its own procurement of products centrally for all of its outlets around the world. Foods are supplied by large transnational companies that can consistently supply large volumes according to exacting standards set by supermarkets. Procurement and distribution for supermarkets is fully integrated, "from farm to table” as they like to say.

There is very little room for small farmers to participate in these integrated supermarket supply chains. One of the main problems is that supermarkets demand adherence to standards for food safety that are impossible for small farmers to comply with.

The Good Agricultural Practices (GAP) standards that were initiated by the retailers have since been promoted through the United Nations' Food and Agriculture Organisation (FAO) and the Codex Alimentarius for translation into national regulations. The standards are officially voluntary, but governments and big food retail chains are increasingly making GAP standards compulsory not only for the sale of products to retailers but also for farmers wanting to access extension, marketing and credit programs. Official documents from the FAO and governments indicate that the goal is to make these standards legally binding.8

Malaysia took a step towards this in 2005, when the government's national standardisation and accreditation body issued the “Crop Commodities – GAP Regulation”.9 The regulation prescribes a generic code of practices based on the EUREPGAP protocol and FAO's GAP. It states that all agricultural producers are legally bound to comply with these regulations

Governments in Asia are making special efforts to ensure that small farmers follow GAP standards. But the standards are not at all adapted to the farming systems of most small farmers. GAP standards typically include requirements such as storage rooms with solid walls and cemented floors; potable water for handling products right after it's harvested (and, in some cases, even for irrigation); strict record keeping of all activities, sales and purchases, use of commercial seeds and other inputs; and hired technical assistance by agronomist or other professionals. GAP standards even ban animals from crop fields and spell out requirements for personal hygiene.

These standards were developed in Europe, and have no relationship to the traditional food systems of Asia. Carrefour's Indonesia fresh products merchandise director told GRAIN that its suppliers must comply with the company's internal procurement standards book. Although Carrefour is now wholly owned by an Indonesian company, Trans Retailindo, the standards book is unchanged. It is almost impossible for small scale Indonesian farmers to comply with these European standards, without access to the farm machinery and advanced post-harvest technology called for. The standards also include precise norms for freshness and product sizes that are suited to industrial agriculture, for example broccoli must have bright green colours with exactly 5 cm of stem.

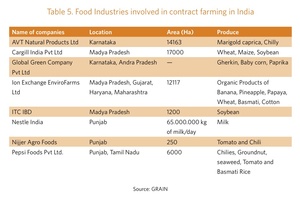

Across Asia, compliance for most small farmers is simply impossible or far too costly. The “solution” often proposed by governments and the food industry is more vertical integration, especially contract farming, so that farmers can concentrate on following GAP in the field and the companies they supply can take over all forms of handling, processing and marketing. This, of course, comes at a cost for farmers, both in terms of higher expenses – since food companies charge for every service – and in terms of loss of control over the marketing process, frequently resulting in low and seriously delayed payments for produce.

“I have been growing vegetables and selling it directly to the consumers in nearby market. I do not know how to sell it to Metro," says Rudresh, a farmer from Hoskote, a rural district in Bangalore. "They only buy the top quality produce, but in the local market I sell all my vegetables, at varying prices, according to the quality.”11

Another farmer from the same district, Sriniwas, says that retail companies are trying to grab a piece of land where a farmers' market has existed for decades. "They plan to build a huge market complex that would of course be occupied by big companies," he says. "Where shall we go and sell our produce?”12

The reality is that even with the increasing number of contract farming programmes, supermarkets source very little of their production from small farmers. Most of their food supplies come directly from large corporate farms. The Thai company Charoen Pokphand is one of the leading suppliers of meat to global supermarkets. Its operations are vertically integrated, from breeding farms to slaughterhouses to food processing plants. The company even operates its own chain of supermarkets (CP Fresh Mart) and convenience stores (7 Eleven).13

Wal-Mart's largest global meat supplier is US-based Tyson Foods, the world's largest meat producer. Tyson is currently spending hundreds of millions of dollars to set up its own operations in China. The company, which had no farms in China just three years ago, plans to construct 90 chicken farms there by 2015. While Tyson's announced plans coincided with a new Chinese tariff on chicken imports from the US, the company maintains that its decision to build its own farms instead of buying from independent farmers is mainly about ensuring food safety and protecting against diseases such as bid flu.14 Wal-Mart's chief executive for China, Greg Foran, also says Tyson’s farms will help the retailer to minimize risk by providing a safe and controlled supply.15

Food safety on sale

In 2011, GRAIN released a report, “Food safety for whom? Corporate wealth vs people’s health”, which shows how trade agreements have become the core mechanism to expand and enforce food safety standard around the world. As agriculture markets have been profoundly liberalised, there has been a boom in the global trade in food.

Too often, the food safety rules that emerge from trade negotiations become mechanisms to force open markets, or backdoor ways to limit market access; they do little to protect public health, serving only corporate growth imperatives and profit margins.

There is no evidence that standards like GAP actually improve the quality of food or reduce the possibility of outbreaks of food-borne diseases.

In fact, global supply chains make consumers more susceptible to food contamination. A small farm that produces some bad meat will have a relatively small impact. A global system built around geographically concentrated factory-sized farms does the opposite: it accumulates and magnifies risk, subjecting particular areas to industrial-style pollution and consumers globally to poisoned products.

Food safety and standards are partly a response to consumer demands, but they are also aggressively promoted as premium products by corporate retailers. Green certification and eco-labelling programmes, for instance, represent a market response to the demand for environment-friendly practices and healthy products. Eco-labelling attempts to capitalise on the price premiums consumers are willing to pay for both the private good of safe food and the public good of an improved environment. While retailers have long marketed the nutritional attributes of ”premium products”, such as health benefits of organic produce, they have only recently begun to market sustainable practice attributes.

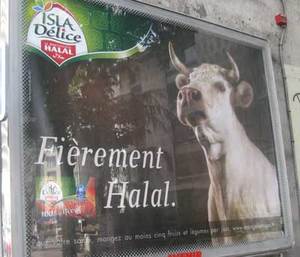

The halal food market is one of the largest and fastest growing certified foods markets, worth around US$700 billion in 2014 according to the World Halal Forum. It has a potential market of 2 billion people worldwide, with 1.4 billion in Asia.

But exactly what constitutes halal food is a highly contested issue. There is no global standard, and in any given country there may be different or even competing standards.16

In his 2011 book, The halal frontier: Muslim consumers in a globalized market, Johan Fischer warns that in the contemporary Muslim world, a halal label is not merely a religious expression of what is allowed or not. It is also a connection between the Muslim world and a new expanding global market of production, trade and consumption. Halal labelling is the key to growing export markets in predominantly Muslim countries.

The major supermarket and fast food chains target halal consumers in partnership with a wide range of commercial and religious organisations linked to different schools of thought. The UK based supermarket chain Tesco was the first global retailer to start selling halal meat in 2000. The French group Casino, which owns the Big C supermarket chain, and the German based supermarkets Aldi and Lidl, followed suit. These chains, however, have been criticised by Muslims organisations, such as the Halal Monitoring Community, for being disrespectful to Muslims, for their lack of transparency and for their failure to guarantee that their products were really halal.17

Food sovereignty at stake

Mega retailers want to offer the same fresh fruits and vegetables all year round, whether they are in season or not. They are able to do so by sourcing produce from different geographic locations around the world. But they also want products for as cheap as possible. So they look for production centres where they can source at the lowest cost. China for instance is becoming a major production and distribution centre for poultry and horticulture products for supermarkets in many countries in Asia.

The growing number of free trade and investment agreements in Asia facilitate global procurement systems for retailers. Since coming into effect in January 2010, the ASEAN-China Free Trade Agreement (ACFTA), one of the most controversial trade agreements in the region, allows zero tariffs for more than 600 agriculture products from China to South East Asian countries.

Supermarkets will also reap big benefits from the Asean Economic Community (AEC), which comes into being in 2015. The AEC will fully integrate Southeast Asian countries according to five core elements: free flow of goods, free flow of services, free flow of investment, free flow of capital, and free flow of skilled labour. The Thailand based wholesale chain Siam Makro has already set up new outlets along the Cambodian border not just to target new consumers but also to benefit from neighbouring country suppliers that might offer lower prices than Thai producers.18 Siam Makro chief executive Suchada Ithijarukul confirms that they are also seeking these opportunities in Laos.19

The growth of these vegetable oils is highly concentrated in specific areas of low-cost production – Brazil and Argentina for soybeans, Malaysia and Indonesia for oil palm and Canada and China for canola. The dominance of these vegetable oils has undermined the viability of other oil crops such as coconut, groundnut, sunflower, cottonseed and olive. Import tariffs on vegetable oils in India were reduced three times under the pressure from World Bank Structural Adjustment Programme (SAP), starting from 65% in 1994, to 20% in 1996 and 15% in 1998. Prior to 1994, importation of vegetable oils were determined by Indian government based on factors like domestic market conditions and the availability of foreign exchange.21

The effect on edible oil producers in India has been catastrophic. Over ten years, the price paid to the four million coconut farmers in the state of Kerala, for example, dropped from 10 rupees a piece to just 2-3 Rs a piece. The fatal blow came in April 2008 when the import duty on all crude edible oils was reduced to zero.22

The suicide rate among farmers soared. According to official data, on average nearly 16,000 Indian farmers committed suicide every year over the last decade: one every half an hour. The free-falling price of vegetable oils and debt linked to failed GM cotton crops are the two leading causes.23

Super markup for consumers

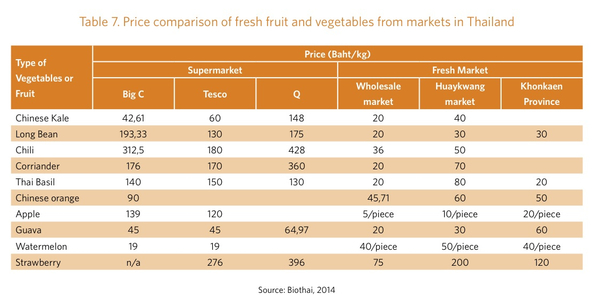

Supermarkets bombard the public with flyers and advertisements offering discount prices on certain foods that they sell in their stores. The message they're trying to put across is that supermarkets offer food at low prices. What most consumers do not realise however is that foods in supermarkets in Asia often cost 3 or 4 times more than the same produce sold in fresh markets, even though the quality and safety of the products is not better.

In early 2014, the Thai Pesticide Alert Network and the NGO Biothai carried out a study of produce sold in supermarkets in 5 provinces around Bangkok. They found a staggering 62.5% of fresh fruit and vegetables with Q labels – the label indicating produce grown and processed according to GAP standards – contained pesticide residues above legal levels. The same study found only 33.8% of samples of produce sold in fresh markets – where nothing is labelled – contained pesticide residues exceeding the legal levels. Yet, the supermarkets sell their Q label fruits and vegetables for a higher price than the same produce sold in the nearby fresh markets.

Global retailers, tax avoiders

Global retailers use elaborate ownership structures to shift their profits to jurisdictions with low corporate tax rates and conceal the true value of their operations from tax authorities.

The French senator and former Minister of Finance, Jean Arthuis, says that the big supermarkets use a secretive tax avoidance scheme that cheats the French government out of between 2-4 billion euros every year and raises prices paid by consumers. Arthuis says that thanks to their market power, the supermarkets are able to force their suppliers to pay them a fee of between 2-3% of the sale price on every product sold. The fees are paid to subsidiaries of the supermarkets based in low tax countries such as Switzerland, Belgium, and Luxembourg, and officially claimed as fees for things like statistical studies or corporate international development.25

Another way that global retailers avoid taxes is by charging their own subsidiaries inflated charges for royalties or services. Walmart's UK retail subsidiary Asda paid almost £870m to its US parent company for “technical assistance, services and royalties” between 2004-2011. These internal payments slashed Asda’s declared profits and reduced its UK tax bill by an estimated £250m.26

In the US, Walmart hired the accounting firm Ernst & Young LLP to help it devise ways to minimize state taxes. Working from the "Tax Shelter Room" at Walmart headquarters, the firm devised several schemes including an elaborate real estate structure that saved Walmart at least $230 million on its tax bills in dozens of states and cut its state taxes by around twenty percent. Under the scheme, Walmart transferred ownership of land on which its stores operate to a real estate investment trust owned by Walmart in the tax haven of Delaware. Walmart stores would then pay rent to the Delaware trust, which would then pay the stores back in yearly, tax-deductible dividends. One North Carolina trial court ruled that "there is no evidence that the rent transaction, taken as a whole, has any real economic substance."

Through such complicated tax avoidance schemes, Wal-Mart is estimated to have paid, on average, only half of the statutory state tax rates during the years 1997-2007.27

Nutrition transition and changing dietary patterns

One of the most important challenges that Asia faces today is how to feed its large and growing urban populations. Urbanisation bring with it changes in life styles and consumption patterns, marked by rising demand for semi-processed or ready-to-eat foods. Supermarket chains are positioning themselves to take advantage of this situation and become the main suppliers of food to the region's urban centres.28

Vertically integrated food supply chains linking producers, processors, distributors and retailers become essential for meeting the changing demand, which supermarket chains rapidly facilitate by policy changes of trade and investment liberalisation. Foreign investment plays a role in the nutrition transition by shaping the processed foods market and making it more available to more people. In India, the FDI inflow for the food processing industry was $117 million in 2011, rising to $2.15 billion by the end of 2013. The Indian government has initiated a plan to create 30 mega food parks across the country.29

Processed foods typically have little nutritional value and contain high levels of saturated trans-fatty acids, salt and sugar that help with preservation and enhancing flavours but that are linked to obesity and food related diseases such as diabetes, cholesterol and heart disease. Thus, as supermarkets take over more of the food supply, consumption of these processed foods goes up, as does obesity and other food-related health problems.32

Today various studies show there are far more obese people in the developing world than in richer countries. Future diets, an analysis of public data about what the world eats said that between 1980 and 2008, numbers of overweight and obese people in the developing world increase more than tripled, from 250 million to 904 million. Meanwhile in the same period number of overweight and obese people in developed countries increased “only” 1.7 times.33 China, India, Pakistan and Indonesia – the Asian countries with fastest supermarket expansion – are all now amongst the ten most obese countries in the world.34

No country in the world faces a bigger challenge to feed its rapidly growing urban population than China. More than half of China's 1.3 billion people now live in urban areas, up from around 400 million just a decade ago. Supermarket chains are rapidly expanding in the country's major cities, playing the role of food suppliers and transforming dietary patterns.

China's urban population mostly eats at home, so supermarkets like Carrefour, Wal-Mart and their Chinese-owned counterparts are the main drivers of changes in dietary patterns, rather than Western-style fast food chains.35 Supermarkets are growing faster in China than anywhere else in the world, and this expansion is now spreading into smaller cities and towns, and even reaching higher-income earners in rural areas.

This growth coincides with a dramatic shift away from the consumption of grains and complex carbohydrates to the consumption of meats and fats. China now both produces and consumes half of the world's pork production. In 2012, Chinese farmers and companies produced 50 million metric tons of pork, twice the amount of pork produced in all 27 European Union countries combined.36 Increased consumption of processed foods also means also increased consumption of fats, and particularly palm oil, the world's discount source of fats. It is estimated that palm oil is found in half of all packaged foods on supermarket shelves.37 In China, the annual per capita consumption of vegetable oils rise from 3 kg in 1980 to 23 kg in 2009, or roughly 64 grams per day – almost twice the fat intake required to meet a person's nutritional requirements. Palm oil now accounts for a third of the vegetable oil consumed in China, nearly three times the share it held in 1996.38

The impact of this dietary change is quickly becoming visible, with the number of obese people in China rising from 18 to almost 100 million between 2005 and 2011. The percentage of overweight people in China rose by nearly 40 percent – its obesity rate nearly doubled – between 1992 and 2002, according to the Chinese Center for Disease Control and Prevention – coinciding neatly with the liberalisation of FDI in retail over the same period..39

Terrible figures: Mexico: obesity, malnutrition and processed food

At first glance, it appears to be a paradox. Mexico has become a country where millions of people suffer from hunger or malnutrition, but many of the same people struggle with obesity and diabetes. But both afflictions stem from the same source: imbalances in nutrition and health related to food consumption and/or availability.

(The solutions envisaged by the government (such as the highly visible Crusade Against Hunger) do not address the real causes of hunger .40 This national anti-hunger crusade targets only 7.8 million persons, just a tenth of the number surveys show are food insecure.)

The combined number of overweight and obese people over the age of 20 is 70.7 million. The increase in the prevalence of obesity in Mexico is among the most rapid document anywhere in the world. From 1998 to 2012, the percentage of overweight women rose from 25 to 35.5%, and the percentage deemed obese jumped from 9.5 to 37,5%.41

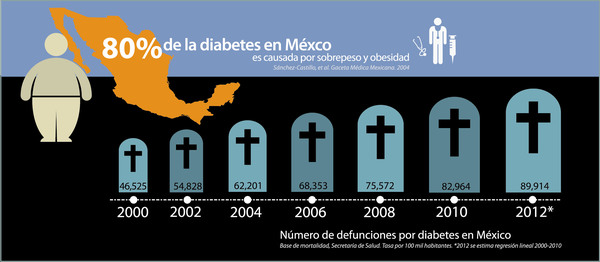

The Mexican Diabetes Federation says between 6.5 and 10 million Mexicans – 7% of the population –suffer from diabetes, but of this total roughly two million don't know it yet. More than one in five people between 65 and 74 is diabetic. Around 13% of the general population is glucose intolerant and 80% of the leg amputations occur in diabetes patients. It is the third leading cause of death, directly or indirectly”, with half a million people dying from diabetes during the last presidential mandate.42 43

The NAFTA connection

The creation of the North American Free Trade Agreement fostered several key aspects of economic integration put forward by powerful partners: of the “food trade and global production sourcing; of direct investment in food processing and a change in the retail structure (notably the advent of supermarkets and convenience stores); and of the emergence of global agribusiness and transnational food companies; deepening global food advertising and promotion.44

Transnational food corporations (TFCs) seek to “locate production of agricultural foods where there is a comparative advantage in producing them” while pushing for the reduction of tariffs and agricultural domestic support in countries where these companies operate. This allows TFCs to assume a greater role not only in producing raw materials, but also in trading , producing and distributing processed food through huge chains of supermarkets and convenience stores through global vertical integration and sourcing.45

In the case of Mexico, NAFTA triggered massive foreign direct investment from the United States into Mexican food processing. In 1999, “US companies invested US$5.3 billion in Mexico's food processing industry, a 25-fold increase from US$210 million in 1987, and more than double the US$2.3 billion in the year before NAFTA”. Between 1999 and 2004, “approximately two thirds of the US$6.4 billion FDI in Mexican agricultural and food industries was from the United States”. 46

It is obvious that NAFTA and the changes in food consumption and availability are related; between 1995 and 2003, sales of processed foods expanded by 5–10% per year in Mexico.”47. The trade policies favour processed and refined foods with a long shelf life rather than on the consumption of fresh and more perishable foods, particularly fruit and vegetables”, aggravating “the overweight and obesity emergency that Mexico is facing”.48

It is no surprise then, that that rates of obesity, diabetes and malnutrition rocketed. In 2014, nine of the world's ten processed food giants, including PepsiCo, Nestlé, Unilever, Danone, Bimbo and Kellogg’s made hefty profits – due to the low costs of operation. These conditions have helped these industries become such a powerful array that Mexico is now one of the ten biggest producers of processed food in the world.50

The net gain of corporations managing processed food in Mexico amounted to 28.33 billion dollars, 46.6% more than Brazil, one of Latin America's giants. The value of the production of processed food in Mexico amounted in 2012 to 124 billion dollars (among the ten biggest producers in the world) according to Global Insight.

For The Economist, it is not only low costs (which amount to a saving of 14.1% compared to USA) but to other competitive advantages such as “reduced competence and a network of trade agreements that permit access to big markets such as the European Union and the USA with tariff preferences”, which make Mexico a kind of haven for food processing, a haven where – in spite of the global economic crisis – “the sales of retail business establishments have grown steadily in the last three years”.51 This is a direct effect of NAFTA and the long trail of commercial and “cooperation accords” signed by Mexico. Mexico is one the countries with more free trade agreements or similar accords signed: 12 free trade agreements with 44 nations, 28 accords for the Promotion and Reciprocal Protection of Investments and 9 agreements of Economical Complementing.52

According to Amy Guthrie, David Luhnow and José de Córdoba, writing for The Wall Street Journal, “Mexico is the world's ninth largest market for processed food. Last year, it was the third largest market by revenue for snack and drink maker PepsiCo, behind only to the U.S. and Russia, contributing 6% of annual revenue, according to the company”.53

Conclusion

The current global food distribution system is unsustainable and undermines food sovereignty. The expansion of supermarkets puts small farmers in direct competition with industrial agriculture, and also has negative impacts on local markets and communities. As more and more people in Asia turn to supermarkets for their food, food diversity is eroded and corporate supermarkets gain more power to determine food systems, from production up to distribution chains and consumption.

The shift towards supermarkets cannot be seen as a solution to feeding growing populations in Asia. It is transferring control over and access to food from millions of small farmers, home food artisans, local food markets, and consumers to a handful of corporations like CP, Aeon, Dairy Farm, Wal-Mart, and other global retailers, and their corporate suppliers from the food industry and agribusiness. It puts at risk the livelihoods of hundreds of millions of people who rely on the food sector for their livelihoods.

Across the region, there is both growing awareness of the threat posed by global retailers and a growing resistance against their expansion. But we must continue envisioning and building strategies and alternatives to the supermarket model of food distribution in order to move forward in a way that strengthens social, community based and public food systems and assures the survival of small food producers and local markets.

Notes

2 Thomas Reardon and Julio Berdegué, "The Retail-Led Transformation of Agrifood Systems and its Implications for Development Policies," World Bank, 2008

4 SMERU Institute, Dampak supermarket terhadap pasar dan pedagang ritel tradisional di daerah perkotaan di Indonesia, 2007

5 Kumar, Dharmendra and Vinay Ranjan, “Corporatizing Agri- Retail: implications for weaker links of the food supply chain. An appraisal of Bengaluru”, FDI Watch, 2011

6 Under District Regulation No.17/2012 on Market Regulation, supermarkets and convenience stores must be at least 3.5 kilometres from existing fresh markets, but this regulation is widely flouted.8 Future Unidroit/FAO legal guide on contract farming, March 2014, pages 10-11. The document clearly states that agricultural producers are bound to apply good practices based on three categories of obligations relating to receiving, taking care of and using inputs according to the guidelines given by the contractor.

9 Department of Standards, Malaysia, "Crop commodities – good agriculture practices (GAP)," MS 1784:2005

10 Kumar, Dharmendra and Vinay Ranjan, “Corporatizing Agri- Retail: implications for weaker links of the food supply chain. An appraisal of Bengaluru”, FDI Watch, 2011

.11 Metro AG, known as Metro Group, is a German global diversified retail and wholesale/cash and carry group. Established in 1964, it is now fifth-largest retailer in the world measured by revenues.

12 Kumar and Ranjan. 2011. Corporitising agri-retail implication for weaker links of supply chain. An appraisal of Bangaluru. FDI Watch.

14 Shruti Date Singh, "Tyson Foods seeks to reverse Chinese anti dumping tariffs on US chicken," Bloomberg, 27 September 2010

15 David Kesmodel and Laura Burkitt, “Inside China's Supersanitary Chicken Farms Looking to Capitalize on Food Safety Concerns, Tyson Shifts From Using Independent Breeders,” Wall Street Journal, 9 December 2013

16 At the international level, the Organisation of the Islamic Conference is the forum that has been trying to come to terms with this. In 2007, the International Halal Integrity Alliance (IHIA) was set up to work with industry, research institutions and other organisations to develop an internationally recognised standard, though a consensus is still far off.

17 John Lever,” The postliberal politics of halal: new directions in the civilizing process?”, November 2013

18 Interview with Siam Makro procurement manager, March 2014.

19 Pitsiniee Jitpleecheep, “Makro plans Asean drive: big retail chain tests market in Myanmar,” Bangkok Post, 21 May 2014

20 USDA, Oil Crops Yearbook Dataset, 2013

21 Eric Dohlman, et al, "India’s edible oil sector: Imports fill rising demand," USDA, 2003

22 Afsar Jafri, ” Trade Liberalisation's Impact on Edible Oil Sector in India,” Focus on the Global South, 2011

23 Zachary Keck, ”Why Do So Many Indian Farmers Commit Suicide?” The Diplomat, 201324 Richard Brooks, The Great Tax Robbery: how Britain became a tax haven for fat cats and big business, OneWorld Publications, 2013; and Richard Murphy, "Tescos: the Zug deal is tax avoidance," June 2008

25 Nolwenn Weiler, "La grande distribution française pratique-t-elle l’évasion fiscale ?"Basta Mag, 22 July 2013 ; "La distribution accusée de toucher des commissions offshore," Le Parisien, 16 July 201326 Gemma Goldfingle, "Asda comes under scrutiny for tax avoidance," Retail Week, 29 October 2012

27 Jesse Drucker, "–Friendly landlord: Wal-Mart cuts taxes by paying rent to itself," Wall Street Journal, 1 February 2007; Jesse Drucker, "Inside Wal-Mart's bid to slash state taxes,” Wall Street Journal, 23 October 2007

29 Investment Opportunities in the Indian Food Processing Sector

30 Corrina Hawkes, "Globalization and the Nutrition Transition," Cornell University, 200731 Tara Parker-Pope, “A high price for healthy food,” New York Times, 5 December 2007

32 BM Popkin, “Global nutrition dynamics: the world is shifting rapidly toward a diet linked withnoncommunicable diseases,” American Journal of Clinical Nutrition 2006; 84(2):289–298

33 Keats and Wiggins, “Future diets: implications for agriculture and food prices,” Overseas Development Institute, January 2014

34 Jennifer Viegas, "Top 10 countries with the most obese people named," Discovery News, 28 May 2014

35 Popkin, BM, "Will China’s Nutrition Transition Overwhelm Its Health Care System And Slow Economic Growth?" Health Affairs, 2008

36 Schneider, M. and Sharma, S. 2014. China’s Pork Miracle? Agribusiness and Development in China’s Pork Industry. Institute of Agriculture and Trade Policy37 Rainforest Action Network, "Conflict palm oil,” September 2013

38 Dinesh C. Sharma, "Rise in oil consumption by Indians sets off alarm," India Today, 2 April 2012; FAOSTAT

39 Sky Peterson, “Obesity in China: Waistlines are Expanding Twice as Fast as GDP.” US-China Today, 4 August 2011

40 Julio Boltvinik, “La Cruzada Nacional contra el Hambre: ve un árbol pero no el bosque”, La Jornada, 22 November, 2013

41 Julio Boltvinik, op.cit.

42 Roche Diagnostics, Diabetes en México

43 Alianza por la salud alimentaría, “Diabetes: #1 causa de muerte en México”

44 Corinna Hawkes, “Uneven dietary development: linking the policies and processes of globalization with the nutrition transition, obesity and diet-related chronic diseases”, Globalization and Health, BioMed Central, 28 March 2006

45 Vertical integration is “when a company brings together the entire process of producing, distributing and selling a particular food under its control by buying and contracting other companies and services worldwide, thus reducing the “transaction costs associated with having different suppliers”. Global sourcing is when a company searches for inputs, production sites and outputs where costs are lower and regulatory, political and social regimes favourable – enables TFCs to cut costs and helps safeguard against the uncertainty of commodity production and product sales Corinna Hawkes, op.cit.

46 Corinna Hawkes, op.cit.

47 Ibidem.

48 Report of the Special Rapporteur on the Right to Food, Olivier De Schutter, addendum, Mission to Mexico, Human Rights Council, Nineteenth session, Agenda item 3, 17 January, 2012, A/HRC/19/59/Add.2

49 Ibidem.

50 Roberto Morales, “Alimentos, una industria muy pesada,”, 25 October 25 2013, El economista,

51 op.cit.

52 México y sus Tratados de Libre Comercio con otros países

53 Amy Guthrie, David Luhnow and José de Córdoba, “Companies Brace for Mexican Food Fight,” The Wall Street Journal, 18 October 18, 2013